Divorce Preparation Checklist

Financial Records -- Home & Property Information

Finding yourself getting ready for a divorce can be a very overwhelming process. You probably are having feelings that are causing a lot of doubt and worry. Whether you end up choosing to get a divorce or not, the instructions in this article can help you calm down and feel like you have gained some control. This list is helpful for people who are preparing to get divorced. However, this list will also help you compile and organize information that is important to have whether you choose to get divorced or not.

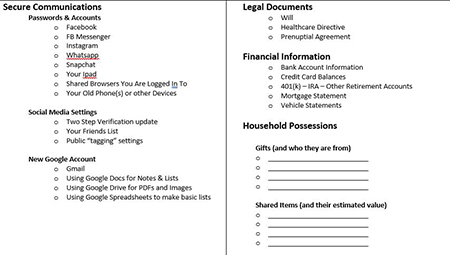

Step 1 - Securing Your Communications

If you still live with your partner and anticipate getting mail (from an attorney, a new credit card or other statements you need to keep private) you may want to open a PO Box. It is also important to think through all aspects of your security as it pertains to technology, acounts and devices - that includes:

-

Changing passwords / creating new accounts

Think about the obvious stuff like Facebook / Messenger / Whatsapp / Instagram / SnapChat and more… also think about if and where you have 2-step verification set up. Is that set to your phone number? Is your spouse’s email set up as a secondary email? Because those types of openings can allow them to gain access. -

Social Media Settings

- Your friends list

If your friends list currently set to public or private? Is there any reason to think your spouse would be contacting your friends?

- Can you be publicly “tagged” in other people’s pictures?

In your privacy settings you can allow or not allow other people to tag you in pictures. Whether it’s an emotional spouse tagging you in old wedding photos or a vindictive spouse tagging you in some stupid meme… you don’t need that. Turn off settings allowing others to tag you publicly.

- Your friends list

-

A Google / Gmail Account

A very good way to manage all of this is by creating a new email account. If you chose to do that through gmail, you will also have the option of using their documents, spreadsheets, and Google drive under that same account. -

Gmail - A private gmail account can be used to communicate with your lawyer or close friends.

-

Docs - This is basically like a word document online. A great place to keep lists, make notes or simply copy & paste text from other places. You can create a folder that will help keep everything organized.

-

Drive - Google drive is an online storage service. So this is what you would use if you had, for example, a PDF of your tax returns or some other document that needed to be uploaded.

-

Spreadsheets - Even if you do not have a lot of experience using spreadsheets, this would be an easy place to start adding up numbers for a budget.

-

Don’t Share More than you Need to

While you are making efforts to gather, organize and protect personal information digitally, do not forget to do it in real life as well. Be careful about who you share information with. Many of my clients have been surprised by how quickly information traveled back to their spouse from “trusted” friends.

Step 2 - Legal Documents

-

A Will, Healthcare Directive or other estate planning documents

Any documents that are available should be reviewed and if possible, get a copy to store in your Google account. -

Prenuptial agreement

If you have a prenuptial agreement, it’s important that you have an up-to-date copy of that agreement. Read through it and work to understand it. Make notes of any questions you may have. -

Tax Returns / Copies of Deeds for Properties

If you use TurboTax or another online preparer, you would be able to log-in and access your past returns. If you use a tax preparer, they likely would have emailed you a copy for your records.

Step 3 - Financial Information

This information can be difficult to obtain, especially if your spouse typically handles it.

-

Bank account information

Where is your main checking account? Savings account? What account does your debit card link to? Is that your only account? Where does your spouse’s direct deposit go? -

Credit card balances

If you have outstanding credit card balances, knowing how much and with who is important. Making note of what it takes to maintain the minimum monthly payments is important. -

401(k) IRAs other Retirement Accounts

These can be hard to obtain. In some cases just having a loose estimate, or simply knowing they exist is a good start. Ideally you would have the log-in to the current information. -

Mortgage Statements

Mortgage statements don’t change a lot, so even one that is 4 or 6 months old, assuming you have not refinanced since then, is as good as a current one. -

Vehicle Statements

Do you own or lease your vehicles? Will you have access to a vehicle if things suddenly got contentious? -

Some understanding of the monthly living expenses (cable, utilities, cell phones, etc)

This is a very gray area and takes time as each household is unique, but all of the above issues will help you build and understand a framework for your current financial situation.

Step 4 - Household Possessions

Take a simple inventory of things that you would like to keep and their values. Try to take note of things that were given to you as gifts from family vs. things that were bought with shared funds if possible. If you can use a spreadsheet to make a list and attach an estimated value with the item that can be helpful.

Step 5 - Quick Mental Check

What have we done here? Filed for divorce? No. Raised issues with our spouse that we know will lead to a big fight? No. We have simply made a few lists and compiled some documents that are a good idea to have together whether you are pursuing a divorce or not. The hope is that you feel a little more prepared if you do take the next step, but if you do not, the hope is that getting these documents and information together have helped you feel more grounded, in control, and in a better mental state to make the next decision.