Home Equity, Divorce & Asset Division

When two spouses divorce, they go through a process of asset division. There are some assets, like a checking account, that are very easy to divide. These assets are sometimes called “liquid” assets.

For many middle class families, the primary home where they live is typically the most expensive thing they will ever purchase and the most valuable asset that they own. This can cause issues because the primary home is not a liquid asset, so it’s difficult to divide.

The issue of the primary home can be further complicated when there are minor children involved. The home is a harbor of stability for children, and typically it is in the best interest of the children to stay in their primary home if possible. The primary home can become a very complex issue from a financial standpoint, and it can also have a major impact on the custody outcome. In most divorces, a fair amount of the conflict and negotiations are related to the resolution of the primary home.

Starting with the Basics – Home Equity

What is “Equity in a Home”?

Equity is the market value in your home less any mortgages or liens that are on the property.

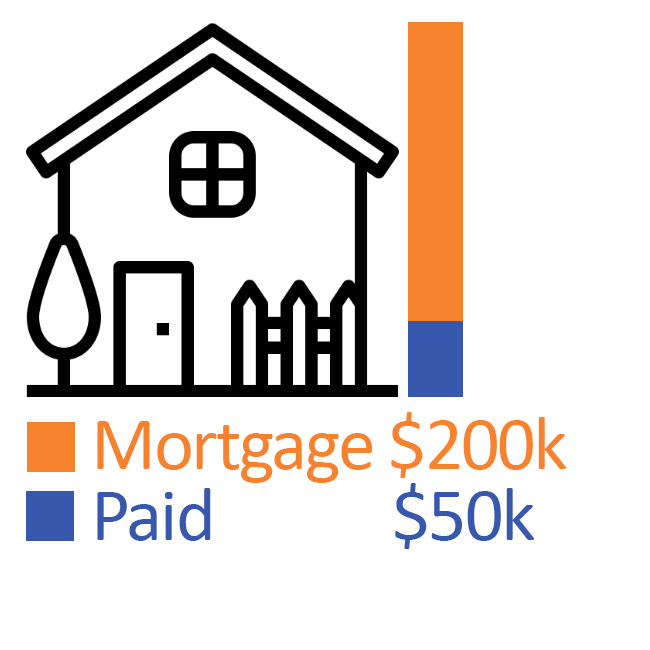

When you purchase a home, there is typically a loan to help purchase the house, called a “mortgage”. You could think of this as the bank owning part of your house, and each month you make a mortgage payment to pay it back. The equity you have in your home is the difference between the mortgage (the amount you have borrowed from the bank) and the value of the home. Another way to think of equity is how much you would walk away with if you were to sell the home.

Why Does Equity Matter in a Divorce?

The amount of equity in the home during a divorce matters because some or all of the equity will be considered community property. A swing in real estate values or a re-valuation of a home can translate to tens, in some cases hundreds of thousands of dollars worth of impact on a divorce settlement.

Let’s look at some variables that can affect how much equity you have in your home:

Market Price – The market price of the house is important because the value of a house can change dramatically even in a short period of time. Typically divorcing spouses would get a home valuation so that they have a fair number to work with. For our example, let’s say that the price of the house at the time of purchase was $250,000.

Down Payment – Now, let’s look at the first factor that would typically create equity, a down payment. Let’s say that you make a 20% down payment on your home. So now the blue will represent how much of your home you own, or the “equity” you have in your home.

At this point, you own $50k of equity in your home, and you owe $200,000 on the mortgage.

Equity over Time

Ideally, two things happen over time. First, you are paying your monthly mortgage payment which will slowly reduce the amount of your mortgage. Most of the time this is on a 30-year plan with interest-heavy payments at the front. The monthly payments, especially early on in the mortgage, do not impact the equity very much.

Focusing on the payments, rather than the change in value can cause a severe miscalculation in the equity of your home. Due to market changes, improvements you have made to your home, or both, your may have increased in value. This is where the real impact on equity happens.

The Home Changes in Value

If your home has changed in value, that will make a dramatic impact on the amount of equity you have in the home. You can see here a shift in home value of $50,000 adds that same amount directly to the equity. So even with these numbers that are no way representative of Southern California Real Estate, this simple re-calculation changes:

- The equity from $56k to about $106k

- This puts an additional $50,000 into community property

- This could translate into another $25,000 to the spouse who is not keeping the home.

Facing a Divorce? A Home Valuation is a must

You can see the current market value of your home has a huge impact on the equity. Determining equity is very important as it’s the most valuable asset many divorcing couples own.

Not Just a Financial Asset. The Primary Home and Child Custody

Beyond thinking about the home as a financial asset, you also should consider how who lives in the home could possibly affect the eventual custody arrangement. Children who are dealing with divorcing parents need stability and routine, and that is often tied closely with the home where they grew up. A child’s proximity to school and friends is important. Make sure that you are considering all downstream effects of the choices you make related to your home. It’s a financial asset, but also a very key piece of the family puzzle.